When you are living primarily on your Social Security benefits, it is essential to create a budget that will allow you to live comfortably without worrying about paying bills or making other monthly payments. For EEOICPA and RECA beneficiaries, free home healthcare services may be available, which can ease some of the financial burden. Regardless of whether you are receiving benefits beyond Social Security, you should learn more about budgeting your payments. The following are some frequently asked questions and answers about learning to budget your Social Security payments.

What Is My Monthly Income from All Sources?

The most important part of budgeting your Social Security payments is knowing how much money you receive each month from all sources, and knowing the total of all of your monthly bills. On average, Americans receive approximately $1,360 in Social Security benefits each month, which means that some people receive more and some people receive less. Most retirees supplement their Social Security benefits with other types of income, from other benefits or retirement accounts, for example. Once you know how much income you receive and how much you owe, you can determine how much you will need to set aside for paying bills.

When Should I Expect to Receive Social Security Payments?

Another important issue in creating a useful budget for your Social Security payments is knowing when you will receive your checks. The Social Security Administration provides a Schedule Of Social Security Benefit Payments, which allows recipients to determine when they should plan to receive their checks each month. Social Security benefits are paid once per month for recipients, and the date of your Social Security check is based on your birth date. The schedule can provide you with clear information about when your benefits will be paid, allowing you to plan ahead for paying your bills.

Can I Use My Social Security Benefits to Pay for Housing?

In an ideal situation, a retired person who is receiving Social Security payments will not need to use that money to make a monthly mortgage payment. However, more and more seniors are making mortgage payments after retirement, and some are even renting homes. You can use Social Security payments to make your mortgage payment, but if Social Security benefits make up the majority of your income, you will need to think carefully about other spending.

Should I Use My Social Security Benefits to Pay for Other Necessities, Like Food and Medical Expenses?

On average, according to the Bureau of Labor Statistics, older adults aged 65 and older spend just over $6,300 per year on food. You should make sure that you plan meals when you are deciding how to budget your Social Security monthly payment. You can also use your Social Security payment for medical expenses, but these can be costly and unexpected for many retirees. If you are able to do so, set aside some of your Social Security payments each month for emergency medical expenses, and also consider other options like Medicare and Medicaid.

Learn About Home Healthcare Services

Creating a budget for your Social Security payments should involve making a list of your monthly income and expenses, determining when you will receive your check, and considering a variety of necessary costs for which you may need to use your Social Security benefits. Budgeting your Social Security does not have to mean that you sacrifice quality care. You may be eligible for home healthcare from United Energy Workers Healthcare and Four Corners Health Care.

Who We Serve

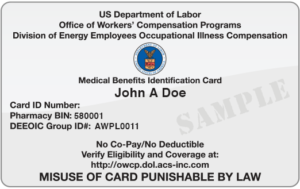

Do you have this card?

If you already have this card, then you are already approved to receive no-cost medical benefits! Call us to get started today.

In order to be eligible for EEOICPA/RECA benefits, an individual must have been employed at a covered Department of Energy facility, an approved atomic weapons facility, or at a permitted beryllium vendor. An individual must also have one of the covered conditions as a result of exposure to radiation, beryllium, or silica while employed at an accepted facility. In addition, uranium miners, millers, and ore transporters are eligible for benefits if they develop an illness as a result of exposure to toxic substances (such as radiation, chemicals, solvents, acids, and metals) and worked at a facility covered under RECA. Eligibility requirements vary by location and condition.